* Past performance is no guarantee of future DST offering results. Future results may vary. Please read each DST investments Private Placement Memorandum for a full discussion of the business plan and risk factors. Potential cash flow, potential returns and potential appreciation are never guaranteed.

- What are the most important areas to evaluate a Delaware Statutory Trust aka DST real estate sponsor firm?

- Why is the potential for preservation of principal through risk mitigation so important for DST real estate investors?

- What is a DST full cycle event and why should DST investors be aware of them?

If you are real estate investor and interested in Delaware Statutory Trusts (DSTs), you only want to consider using the one of the best Delaware Statutory Trust sponsor companies in order to find quality DST properties for your DST portfolio and 1031 exchange.

Cove Capital understands this and always encourages clients to carefully examine any real estate DST sponsor firm before investing with them. Specifically, Cove Capital Investments believes that there are four key areas any investor should examine when it comes to evaluating a Delaware Statutory Trust sponsor company, including:

- Strategic Vision and Positioning within the DST and 1031 Investment Community

- Proven DST Investment Track Record*

- Amount of Skill and Experience within the DST Sponsor Company

- Level of Commitment to the DST Properties they Make Available to 1031 exchange and 1033 exchange Investors

Cove Capital and its current DST offerings stand out in the real estate investment community because the company underscores each one of these real estate investment points in all aspects of its business.

Let’s take a closer look at why Cove Capital Investments is considered by many to be one of the best Delaware Statutory Trust companies by outlining each one of these points.

Point #1:

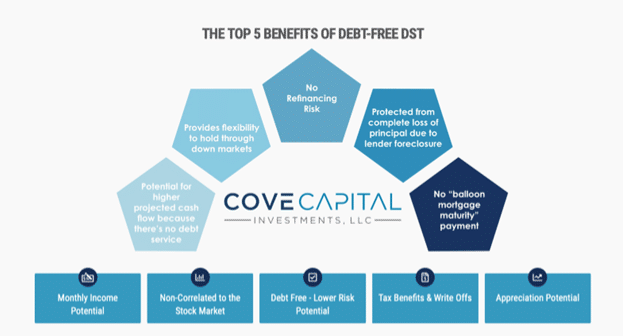

Strategic Vision and Positioning within the DST and 1031 Investment CommunityOne of the things that really sets Cove Capital Investments apart to many investors and industry participants as one of the best Delaware Statutory Trust companies is its vision to lower investors risk potential and distinct positioning in the DST real estate investment marketplace. Cove Capital has taken a contrarian approach to the vast majority of DST real estate sponsor companies in the nation in that we specialize in debt free Delaware Statutory Trust offerings with zero leverage.

This emphasis on offering investors debt free DST real estate offerings is based on the philosophy that preserving investor’s capital should be the number one goal of any DST sponsor firm, and that debt is one of the greatest risk factors in any real estate investment. Remove the debt component, and you simultaneously mitigate a large component of risk.

To really hammer this reality home, readers need only to look at recent headlines that are full of examples of some of the largest real estate firms in the world who are having to give properties back to the bank because they purchased these properties with leverage, and now cannot refinance at acceptable rates to make the investments profitable. Furthermore, these investments were not made by inexperienced amateur investors. On the contrary, in many cases, these firms were led by highly skilled executives with years of real estate experience, and files of successful transactions.

Here are just a couple of examples in the news to illustrate the point that investing in a property with debt can go terribly wrong:

- Recently, one large firm was forced to give back a large office campus in the southwest to lenders after the private investment firm stopped making the payments on its roughly $300 million loan on the office campus.

- One of the of the nation’s largest real estate investment firms located in the Midwest is struggling with the bitter taste of lender foreclosure after their bank filed a roughly $100 million foreclosure lawsuit against the real estate firm over a recent investment gone awry.

- After failing to repay their loan on a Class B complex in the South, an international investment firm was forced to turn the asset back to the lender.

- One global real estate firm recently handed back a large east coast building to its lender after the building’s anchor tenant left the building.

- Fannie Mae recently announced it was prepping for possible losses in the multifamily housing sector as lenders anticipate loan losses from developers and private equity players who used heavy leverage within the multifamily housing sector.

- In the hotel sector, a prominent New York City hotel developer is facing foreclosure after failing to repay a mezzanine loan to a private equity group.

- An upstate New York lender recently announced it was going to move forward with foreclosure proceedings after the owner was unable to make payments on a large self-storage facility near midtown Manhattan.

Avoiding Certain Higher Risk DST Real Estate Asset Classes

In addition, to focusing on debt free real estate assets, Cove Capital Investments also believes in avoiding certain higher risk Delaware Statutory Trust property asset classes in order to further mitigate risk. Specifically, Cove Capital Investments believes there are three asset classes DST investors should avoid when considering investing in either a 1031 exchange DST offering or direct cash investments:

- Student Housing

- Senior Care and Assisted Living Facilities

- Hotel Properties

Point #2:

Proven Track Record*Cove Capital Investments is a Delaware Statutory Trust sponsor company that specializes in debt free DST offerings for 1031 exchanges. Since the founding of Cove Capital, the firm has sponsored more than $682 million of Delaware Statutory Trust investments and created a DST portfolio of 89 quality debt free properties across 32 states. In its most recent year-end report, Cove Capital successfully closed $164 million of equity capital from accredited and direct cash investors, which helped propel Cove Capital Investments into the top 10 list of DST sponsor companies in the nation and recognizing the firm as one of the top Delaware Statutory Trust sponsor companies in the nation based on equity raised.1

Another important measurement for track record performance for Delaware Statutory Trust companies is the investor outcome of full cycle events the company has successfully completed. “Full Cycle” is the name used to describe a Delaware Statutory Trust property that is purchased and then sold on behalf of a group of accredited investors after a period of time.

***However, please note that it is important for all investors to understand that potential cash flow, potential returns and potential appreciation are not guaranteed. There are material risks associated with investing in real estate, DST investments and real estate securities including illiquidity, vacancies, general market conditions and competition, lack of operating history, interest rate risks, general risks of owning/operating commercial and multifamily properties, financing risks, potential adverse tax consequences, general economic risks, development risks and long hold periods. There is a risk of loss of the entire investment principal. Past performance is not a guarantee of future results.

Cove Capital Investments has successfully completed a number of profitable full-cycle events. Below are a sample of some of these full cycle events.

Disclaimer: *Past performance is no guarantee of future DST offering results. Future results may vary. Please read each DST investments Private Placement Memorandum for a full discussion of the business plan and risk factors. Potential cash flow, potential returns and potential appreciation are never guaranteed.

A list of Cove Capital Full Cycle Events

*Past performance does not guarantee or indicate the likelihood of future results.

*Average Annualized return is defined as total return including profit on sale and monthly distributions earned on an annualized basis and is calculated as if an investor closed on their DST investment the same day that the DST closed on the property.

*Total return consists of initial return of investor principal, monthly distributions, and profit upon sale.

| Asset Class: | Single Tenant Net Lease |

| Location: | Greenville, SC |

| Offering Loan-to-Value: | 0% / Debt free |

| Average Annualized Returns: | 12.60% |

| Total Return*: | 121.57% |

| Asset Class: | Multifamily |

| Location: | Missoula, MT |

| Offering Loan-to-Value: | 0% / Debt free |

| Average Annualized Returns: | 18.29% |

| Total Return*: | 149.21% |

| Asset Class: | Net Lease Data Center |

| Location: | Tacoma, WA |

| Offering Loan-to-Value: | 0% / Debt free |

| Average Annualized Returns: | 5.57% |

| Total Return*: | 116.90% |

| Asset Class: | Distribution Center Net Lease |

| Location: | Winston-Salem, NC |

| Offering Loan-to-Value: | 0% / Debt free |

| Average Annualized Returns: | 7.19% |

| Total Return*: | 126.72% |

| Asset Class: | Industrial Net Lease |

| Location: | Elk Grove, IL |

| Offering Loan-to-Value: | 0% / Debt free |

| Average Annualized Returns: | 12.37% |

| Total Return*: | 121.08% |

| Asset Class: | Industrial Net Lease |

| Location: | Washington, D.C. Metro Area |

| Offering Loan-to-Value: | 0% / Debt free |

| Average Annualized Returns: | 8.67% |

| Total Return*: | 126.44% |

| Asset Class: | Debenture |

| Location: | Various Locations |

| Offering Loan-to-Value: | 0% / Debt free |

| Average Annualized Returns: | 7.00% |

| Total Return*: | 109.80% |

Point #3:

Amount of Skill and Experience within the DST Sponsor CompanyThe Cove Capital Investments sponsor team is made up of a group of highly talented real estate professionals that help make the firm a fully integrated real estate investment and Delaware Statutory Trust sponsor team. For example, the Cove Capital team includes:

- Acquisitions Department

- Asset Management Department

- Accounting Department

- Property Review and Analysis Department

- Property Management Department

- In-house Counsel and Paralegals

- Investor Relations

- Marketing

- Capital Markets Group

Having a team of highly experienced and skilled real estate professionals is incredibly important as Cove Capital Investments continues to acquire debt free Delaware Statutory Trust properties at a rapid pace. Afterall, there’s a lot of work that is involved in the acquisition, management, and disposition processes of a DST investment. For example, a great number of our team members are focused on the underwriting and review of the assets during the initial acquisition process. After that, there is a team that specializes in the asset management of the property, and lastly there is the disposition process when the asset is sold on behalf of our investors. Then, on top of these responsibilities, Cove Capital Investments has a team to spearhead the whole investor relations and accounting functions.

Having a superior team of experienced real estate professionals is another reason that helps Cove Capital Investments to be considered by many as one of the best Delaware Statutory Trust companies in the nation.

Point #4:

Level of Commitment to the Properties they Make Available to InvestorsThere is an old expression that goes something like this: "Never trust the food of a cook who doesn't eat their own cooking." Obviously, this wise adage highlights that if a cook is unwilling to consume the food they prepare, it may indicate a lack of confidence in the quality of their own cooking. Going even deeper is the reality that a good chef should have faith in their culinary skills and take pride in what they create.

Metaphorically, this idea can be easily applied beyond the kitchen to the Delaware Statutory Trust real estate investment realm. Or simply put, if a real estate sponsor company has enough confidence in a particular DST property, they should have enough confidence to invest in it right alongside of other investors.

The principals of Cove Capital Investments have sponsored more than 2 million square feet of DST properties in the multifamily, net lease, industrial and office sectors. In almost every case, the Cove Capital principals invest side by side their 1031 exchange investors in each of the Cove Capital DST offerings. Using the above metaphor, Cove Capital principals eats their own cooking.

In Conclusion:

For real estate investors who are interested in Delaware Statutory Trusts (DSTs), selecting the best DST sponsor company for their situation is paramount to potentially choosing the best properties for their DST portfolio. Cove Capital Investments comprehends the significance of this choice and consistently advises clients to scrutinize potential DST sponsor firms diligently. With a focus on strategic vision, a proven track record*, team experience, and solid commitment to its DST real estate offerings, Cove Capital Investments distinguishes itself in the real estate investment realm. Through meticulous attention to each of these critical areas, Cove Capital Investments is viewed by many as one of the best Delaware Statutory Trust companies in the 1031 exchange DST industry.

* Past performance is no guarantee of future DST offering results. Future results may vary. Please read each DST investments Private Placement Memorandum for a full discussion of the business plan and risk factors. Potential cash flow, potential returns and potential appreciation are never guaranteed.

1. Mountain Dell Consulting, 1031 DST/TIC Market Equity Update, 12/31/2023