Welcome to Cove Capital Investments

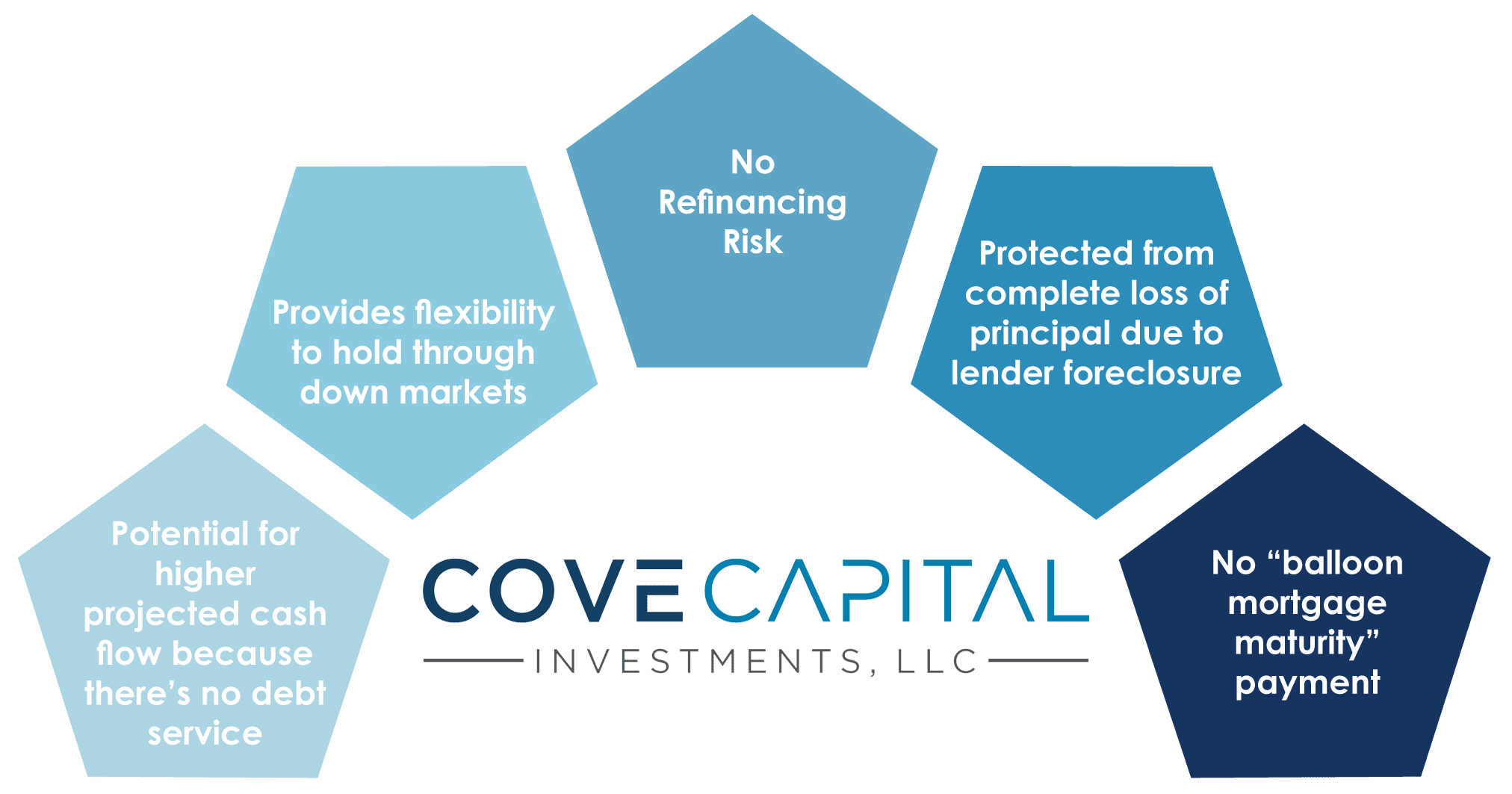

We are different. We are debt free.

1031 EXCHANGE DELAWARE STATUTORY TRUST (DST) AND REAL ESTATE INVESTMENT OPPORTUNITIES

Cove Capital Investments is a Delaware Statutory Trust sponsor company that specializes in providing accredited investors access to debt-free investment options for their 1031 exchange and direct cash investments.

$998M+

in Offerings

3.6M+

Square Feet of Sponsored Real Estate

127

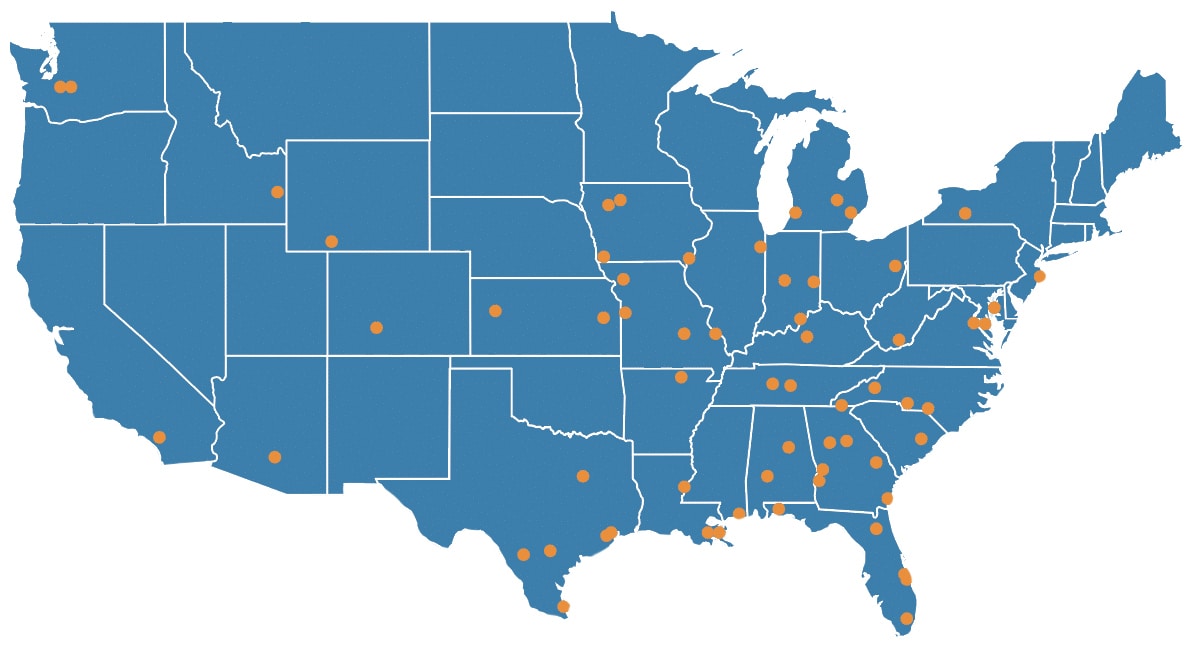

Properties in the Cove Portfolio

2,500+

Cove Capital

Investors

$180M+

in Capital Returned to Investors Since Inception

11.01%

Average Annualized Return on Full Cycle Debt Free DST Offerings*

*Past performance does not guarantee or indicate the likelihood of future results. No representation is made that any DST or investment will or is likely to achieve profits similar to those achieved in the past or that losses will not be incurred on future offerings. All information is as of 10.22.24 and subject to change after this date. For the most updated track record please contact Cove Capital. The individual DST offering average annualized return consists of total distributions and net proceeds upon sale, less the original invested equity, over the life of the investment. The average annualized return on all full cycle DSTs is the total simple average of the individual full cycle DST offerings.

COVE CAPITAL PORTFOLIO OVERVIEW

GET ACCESS TO DEBT-FREE DST 1031 LISTINGS

"I am pleased with the Cove Capital Investments Investor Experience and my additional investment... The Closing experience was seamless and ran well."- Randall L. - Washington DC MSA

"Our experience with Cove Capital has been exceptional. They were really professional. Everything went smoothly, and in a timely manner."- Valerie D. - Millbrae, CA

"Many thanks to Karen and the entire Cove Team, for the highly efficient, professional manner in which you have handled this matter on our behalf. We look forward to a long and fruitful relationship with Cove."- Ross Y. - Napa, CA

"The team at Cove Capital did great letting me know what they needed from me and providing an easy way for me to provide it to them. The professional nature and speed that everything was done was great."- Christopher A. - Herriman, CA

"Thank you and very excited to venture into new investment opportunities. You have been wonderful and the entire process was clear, straight forward and painless. Greatly appreciate the attention and responsiveness."- Helena L. - Los Angeles County, CA

"Very efficient. All of you are very responsive and communicative. All appreciated."- David Y. - Severna Park, MD

"I really wanted to thank you for all the work you did on my two recent DST exchanges. You really know your stuff and keep the ball rolling!"- Robert E. - Alpine, CA

"My experience with Cove Capital has been great thus far. Customer service in general across corporate America has been in decline for a long time so it's refreshing to work with everyone at Cove Capital - everyone is eager to provide assistance and guidance. Whenever I have a question, the response is swift and the information provided is always useful. I would recommend Cove Capital to anyone interested in learning about and investing in real estate based products."- Anthony B. - Campbell County, VA

Cove Capital Tenants

These testimonials may not be representative of the experience of other clients. Past performance does not guarantee or indicate the likelihood of future results. These clients were not compensated for their testimonials. Please speak with your attorney and CPA before considering an investment.