Managing Member and Founding Partner

Cove Capital Investments

For investors considering Delaware Statutory Trust assets for their 1031 exchange, there are a plethora of different asset classes from which to invest. For example, there are multifamily, office, retail, student housing, build-for-rent communities, single-tenant net lease, and hospitality real estate. But out of all of these asset classes for DST 1031 real estate, industrial properties continue to be one of the most attractive asset classes for Cove Capital Investments.

So why should investors consider industrial real estate as an asset class for a 1031 exchange Delaware Statutory Trust investment? While this article will discuss multiple reasons why we believe that industrial real estate should be a part of any DST portfolio, they all revolve around the core concept of risk mitigation. In fact, Cove Capital specifically looks for properties to acquire that have a potentially lower-risk profile than the higher risk DST asset classes (think hotels, senior care and student housing) and have shown to be potentially more resilient to downside pressures. While past performance does not guarantee future results, understanding how a certain asset class has performed in the past is something that should be considered.

Reason Number One: Rental Rates:

The average asking rental rates for industrial real estate in 2023 rose 20.6% year-over-year. Across the industrial landscape, rental rates have increased this dramatically due to increased demand which is outpacing supply. Even with new supply coming online, that new supply has been relatively well absorbed and as a result has pushed rental rates higher. Of course, past performance of rental rates does not guarantee the future and all investors should understand that rents can definitely go down (which is why we believe being debt free when investing in Delaware Statutory Trust 1031 exchange properties can potentially make a lot of sense).Reason Number Two: Vacancy Rates

Currently, the average vacancy rate nationwide for industrial properties is hovering around 3.8% with many markets maintaining a sub 2% vacancy rate. This remarkably low vacancy rate again showcases that demand has been strong as well as it is one of the reasons that rental rates have been increasing at this impressive pace. As all investors should be aware, low vacancy rates can quickly turn into high vacancy rates thereby putting pressure on landlords which is why it is important to always note that the past performance of any one asset class never guarantees the future of that asset class and its performance.Reason Number Three: Growth Trends

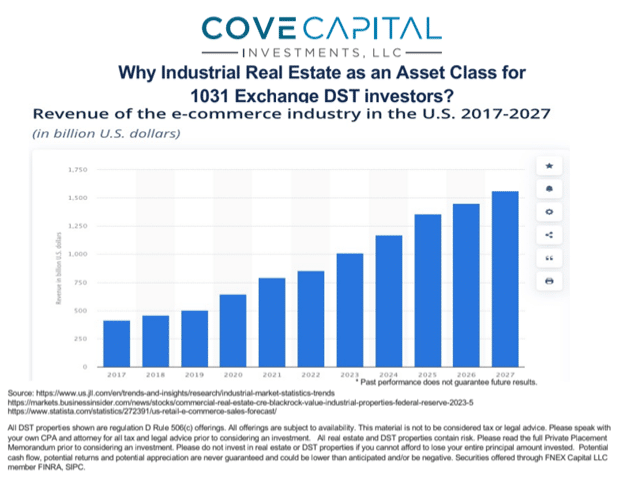

The surge in e-commerce businesses and online shopping has created a significant growth trend that has positively impacted industrial real estate. The number of people buying and shopping online today as compared to 10 years ago is staggering. In addition, the growth of Amazon and other online retailers has also helped catapult this trend.

Taking a look at the numbers as presented by statistia.com, it shows revenue for the e-commerce market in the US is forecast to increase by approximately $551 billion between 2023 and 2027. This growth represents a 54% increase and by 2027 industrial property revenue will have potentially increased for the fourth consecutive year to 1.6 trillion US dollars.

With trends like this, it is no wonder e-commerce is revolutionizing industrial real estate as the need and demand for logistics and warehousing space are growing exponentially. As always, no one can predict the future and the past performance of industrial real estate never can guarantee future results.

Another trend that is impacting industrial real estate for DST 1031 exchange investors includes geopolitical fragmentation which includes the trend for onshoring by US corporations. One of the reasons for this is that there are so many disturbances occurring around the globe these days that US corporations want to limit any potential global supply chain disruptions by bringing as much manufacturing and distribution onshore as possible. The recent COVID-19 virus demonstrated just how damaging a supply chain disruption can be. Prior to COVID, manufacturing, distribution, and logistics facilities were often located outside of the US for cheaper labor costs. However, now many US corporations are moving their distribution facilities onshore, and this trend is fueling demand for the US industrial real estate space. This trend is no guarantee for the future and investors must always remember that things can and will change.

Reason Number Five: Essential Businesses

This final reason is actually very interesting because it hits home at Cove Capital. Since our founding, Cove Capital as a DST sponsor company has sponsored approximately 60 Delaware Statutory Trust properties for DST investors and has a portfolio of over 1.9 square feet of real estate under management. This portfolio held up extremely well during COVID-19, and one of the reasons it did so was that many of our tenants were essential businesses that could continue to operate during the pandemic while others were forced to shut down. Coincidentally, many industrial tenants are considered essential businesses and therefore remained open and paying rent to DST investors each and every month. Obviously, past performance does not guarantee future results, but because industrial DST property assets have some pretty favorable statistics behind it, some pretty favorable growth trends behind it, the e-commerce boom behind it, and then on top of those reasons, a majority of industrial property tenants are considered essential businesses, we feel that this asset class potentially makes a lot of sense for many investors and should be considered when thinking about utilizing the Delaware Statutory Trust for a 1031 exchange.

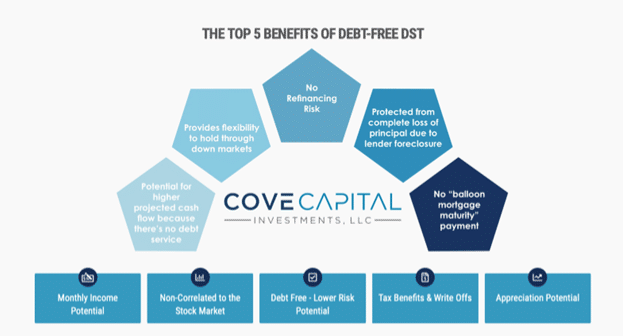

A Word or Two About Debt-Free DST Real Estate Offerings

The vast majority of the properties Cove Capital has in its portfolio are unleveraged DST investments. This emphasis on debt-free offerings is not by accident, it’s by design. The reason is simple: Cove Capital is very risk-averse and hyper focused on protecting our investors capital from a lender foreclosure. Because there is never any guarantee for appreciation or rental income, all types of real estate and DSTs are already considered risky investments. Therefore, Cove Capital works diligently to mitigate as much risk as possible for our investors in our Delaware Statutory Trust offerings. In the example, industrial properties featured below, all of them are considered debt-free offerings.

Examples of Cove Capital Industrial DST Properties

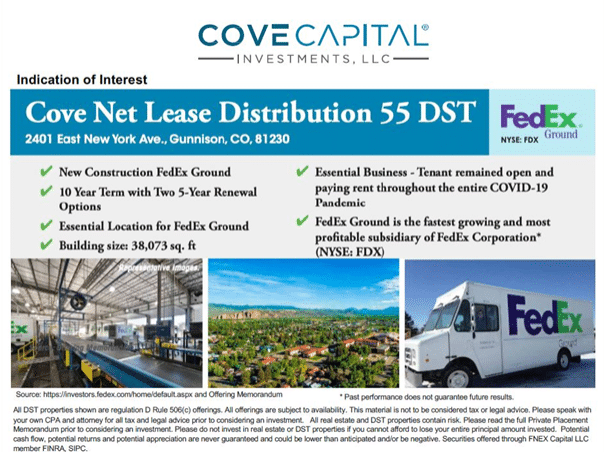

Cove Net Lease Distribution 55 DST

Examples of Cove Capital Industrial DST Properties

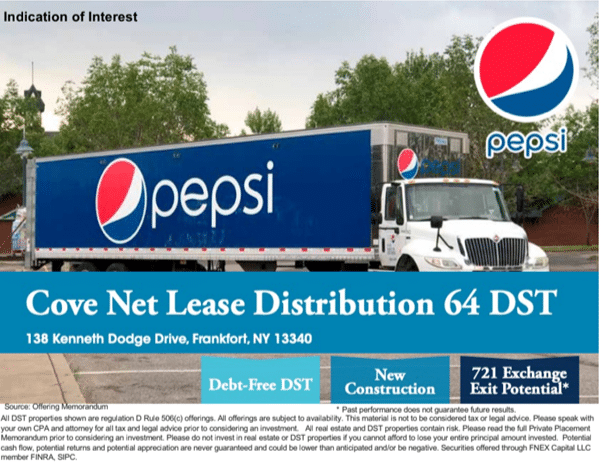

Cove Net Lease Distribution Center 64 DST

Examples of Cove Capital Industrial DST Properties

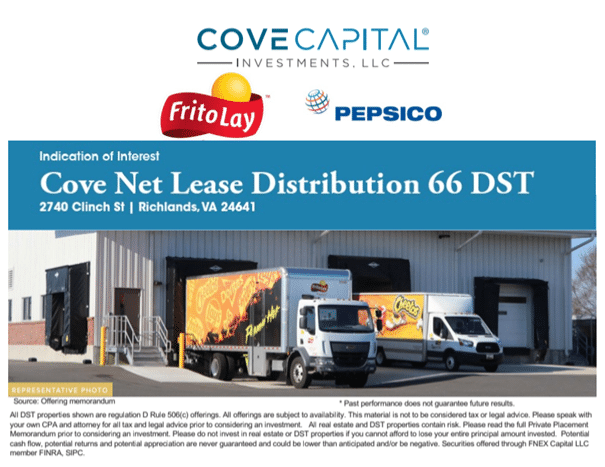

Cove Net Lease distribution 66 DST