- What are the best DST investments?

- Why are debt-free DST investments considered potentially safer than those with leverage?

- What are some examples of debt free DST properties?

- What to look for in DST Properties for Sale?

While commercial real estate has traditionally been an investment class available to only very large investment firms and elite individual investors, the Delaware Statutory Trust structure allows investors to access the best DST properties in fractional shares, giving smaller investors the opportunity to access real estate investments that would otherwise be out of reach for most individuals.

**Still, the question that is often asked by Cove Capital Investments clients is what are **the best DST investments?** While this question could be answered many ways by different real estate sponsor companies, Cove Capital believes that the best DST properties for sale are those that are debt-free.**

The Cove Capital Answer to What Are the Best DST Investments?

This emphasis on debt-free real estate is what sets Cove Capital apart and is a major point of differentiation from other real estate Delaware Statutory Trust sponsor firms who acquire investment grade real estate assets using leverage.

By acquiring real estate assets with zero leverage, Cove Capital is really removing a large amount of risk from the equation for 1031 exchange and direct cash investors. We believe that debt-free real estate investments make the best DST investments for several reasons. However, before we explain some specific reasons why debt free DST offerings can help investors reduce risk, let’s look at what exactly are some examples of debt free DST offerings.

Why Cove Capital Believes Debt-Free Real Estate Assets Make the Best DSTs

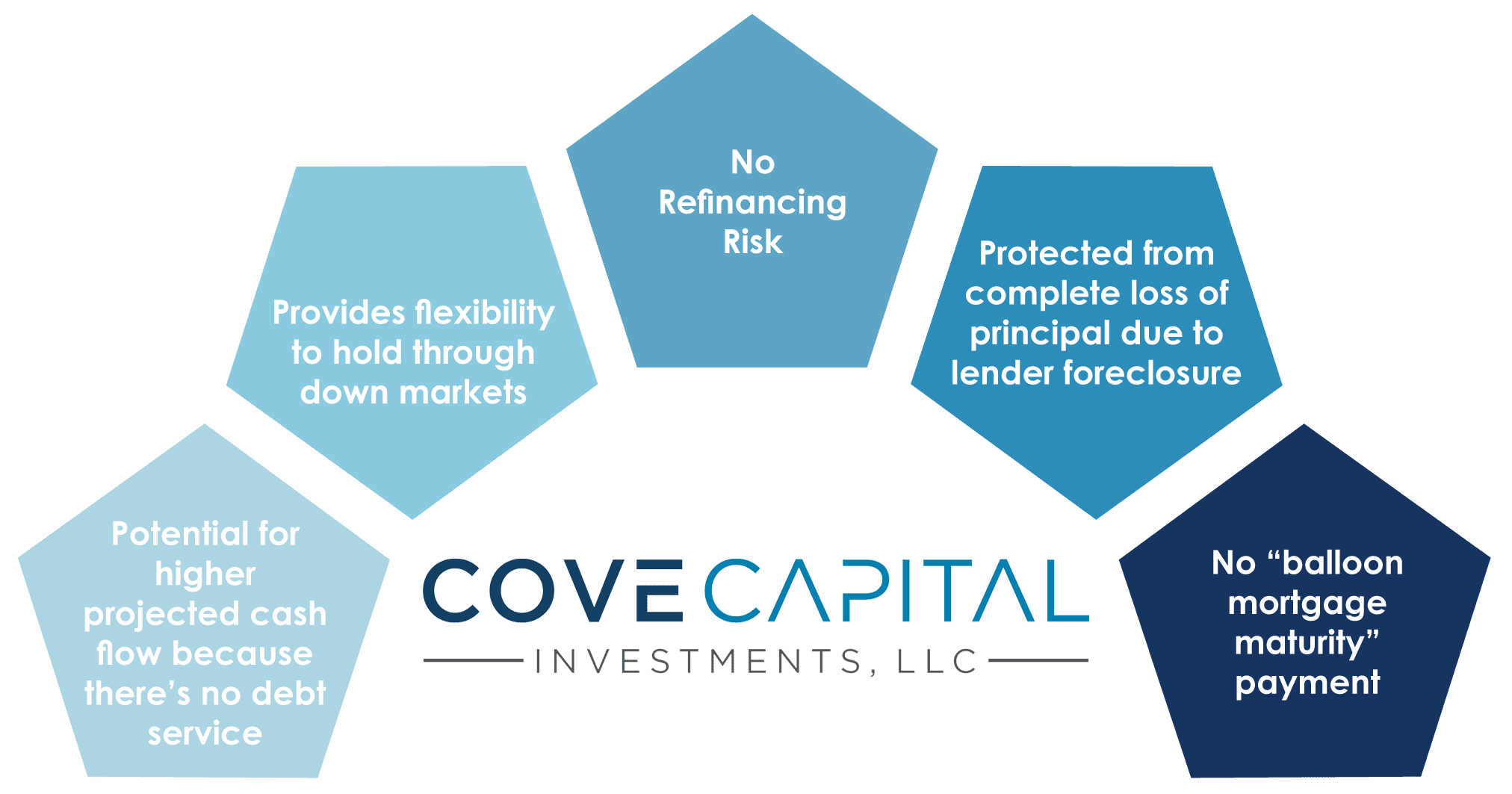

Here are some specific reasons why Cove Capital believes that debt-free real estate assets can potentially benefit investors through reduced risk and therefore can be considered some of the best DST investments for investors.

- Debt-Free Real Estate Reduces Overall Risk to Investors The first and foremost of these reasons is that debt-free real estate investments reduce the overall risk profile for investors. While there is never any guarantees of profits or asset appreciation when it comes to real estate investments, by investing in debt-free DST assets, investors are removing all of the challenges associated with a lender and financing equations.

- Debt-Free Real Estate Provides Investors Greater Flexibility Another reason Cove Capital believes that debt-free real estate makes the best DST investments is because by removing the leverage component of real estate, investors have greater flexibility to hold through any potential market downturns, credit crunches, recessions, or even depressions.

- Debt-Free Real Estate Helps Investors Avoid Cross Collateralization One of the things lenders will often insist on from investors is the need to use multiple assets as collateral to secure a single loan. Called cross collateralization, this action allows the lender to lay claim to all the collateralized properties in the case of default. With debt-free real estate investments more and more retail investors are entering the world of commercial real estate investing. Debt-free DST investments avoid the need for cross collateralization.

- Debt-Free Real Estate Eliminates the Risk of Lender Cash Flow Sweeps One of the unrecognized risks of leveraged real estate offerings for 1031 exchange investors is a cash flow sweep from the lender. Cash flow sweeps or sometimes called "cash traps" can be triggered by a number of situations at the property level. This could include a tenant having their credit rating downgraded, drop in occupancy levels, or overall performance issue at the property. All of these scenarios could potentially allow the lender to sweep all excess cash flow. Many investors are not aware that these cash flow sweep risks are included somewhere in the loan documents. Debt-free DST 1031 exchange real estate has no lender and therefore no risk of cash flow sweeps.

- Debt-Free DST Real Estate Offerings Can Potentially Provide Higher Cash Flow One of the things that Cove Capital is seeing in today's higher interest environments is that some of debt-free real estate offerings have a higher projected cash flow than leveraged DST investments because there is no monthly debt service that needs to be paid to a lender.

- Debt-Free Real Estate Offerings Have No Balloon Mortgage Maturity Payment Most leveraged DST properties have a balloon mortgage maturity attached with the loan. The balloon mortgage is a hard maturity date. That means if you don't sell the property by that date or pay back the loan, then the lender will seek to take back the property through a foreclosure or other mechanism. Debt-free DST properties don't have balloon mortgage maturity payment risks associated them.

The Cove Capital team is comprised of a group of highly seasoned real estate professionals with hundreds of years combined experience, and one area that each member of this team has in common is their experience seeing - through the course of their careers- that the most successful investors are those that have the flexibility to hold through potential down markets. Debt-free real estate adds an additional layer of flexibility for investors.

Examples of Debt-Free DST Real Estate Investment Options

| Asset Class: | Single Tenant Net Lease |

| Leverage: | 0%/100% Debt-Free |

| Location(s): | Encinitas, CA |

| Minimum Investment: | $50,000 |

| Current Distribution: | Monthly/Inquire |

| Offering Type: | DST |

| 1031 Exchange Qualified: | Yes |

Property Description

Cove Pharmacy Net Lease 65 DST is a debt-free Walgreens Pharmacy located in the irreplaceable Encinitas, CA location. The tenant recently signed a lease extension for 15 years, demonstrating a strong tenant commitment to the location. Corporately guaranteed by Walgreens Corporate.

The subject property is in a dense commercial thoroughfare in a prime coastal region of San Diego County. The property also neighbors major regional retail centers like Encinitas Marketplace, Encinitas Village Shopping Center, and Camino Real Shopping Center, and has strong reported store sales.

World-Class Southern California Location

Encinitas is a beach city in the North County area of San Diego County. Located within Southern California, it is approximately 25 miles (40 km) north of San Diego, between Solana Beach and Carlsbad, and about 95 miles (153 km) south of Los Angeles. As of the 2010 census, the city had a population of 59,518, up from 58,014 at the 2000 census.

Property Highlights

- Irreplaceable Southern California Location

- Long-Term Lease - 15 Years

- All-Cash / Debt-Free DST

- Top Performing Location

- Essential Business - Remained Open During COVID-19 Pandemic 100% Occupancy

| Asset Class: | Single Tenant Net Lease |

| Leverage: | 0%/100% Debt-Free |

| Location(s): | Miami Beach, FL |

| Minimum Investment: | $50,000 |

| Current Distribution: | Monthly/Inquire |

| Offering Type: | DST |

| 1031 Exchange Qualified: | Yes |

Property Description

Cove Pharmacy Net Lease 46 DST is a newly constructed (2021) CVS in an irreplaceable Miami Beach location. The property is leased through 2046 with multiple renewal options. Corporately guaranteed by CVS Health Corp. (NYSE:CVS) Located in an income-tax free state.

One block from the beach on Collins Avenue, strategically located along W 41st St., Which serves as the main point of entry to Miami's iconic beaches. The offering is an all-cash/debt-free DST investment with no risk of a lender foreclosure.

MSA Details

Widely seen as the Gateway to Latin America, Miami-Dade's influence has now expanded to global proportions with over 1,200 multinational corporations located in the area. International capital flows into Miami, while the city itself is investing billions into its infrastructure, from airports to seaports. The region's transit system is also expanding rapidly with new local rail lines, and Virgin Trains' highspeed rail system connecting the entire South Florida market, with plans for service to Orlando and Tampa in the future. The 2,400-square-mile county is located on natural and man-made barrier islands between the Atlantic Ocean and Biscayne Bay, the latter of which separates the Beach from the mainland city of Miami.

Property Highlights

- Irreplaceable Trophy Miami Beach Location

- Long-Term Lease - 25.5 Years

- All-Cash / Debt-Free DST

- New 2021 Construction

- Investment Grade Tenant BBB S&P rating

- Essential Business - Remained Open During COVID-19 Pandemic 100% Occupancy

| Asset Class: | Multifamily |

| Leverage: | 0%/100% Debt-Free |

| Location(s): | Dallas-Fort Worth MSA |

| Minimum Investment: | $100,000 |

| Current Distribution: | Monthly/Inquire |

| Offering Type: | DST |

| 1031 Exchange Qualified: | Yes |

Property Description

Cove Dallas Multifamily 59 DST is 159-unit garden-style community in the Dallas-Fort Worth MSA. The sponsor has elected to pursue a value-add strategy encompassing interior unit renovations, which include new quartz countertops, stainless steel appliances, upgraded plumbing & lighting fixtures, and wood-like flooring. Communal amenities include a swimming pool, fitness & business centers, grilling area, and on-site laundry facility. Located 20 minutes from downtown Dallas and is within 2.5 miles driving distance to multiple employers, restaurants, and retailers.

MSA Details

Dallas-Fort Worth led all major U.S. metros in terms of annual delivery volume in each of the past four years, and it was not particularly close. Over that span, the Metroplex added more than 100,000 rentals, exceeding New York City by 24,000 units, which was the second highest-ranking market in that period. This year, Dallas-Fort Worth once again lays claim to the nation1s largest pipeline, though the pace of building has eased. Projected inventory growth of 2.5 percent in 2022 will be the slowest expansion in eight years. The moderation in development comes at a time when the market is adding new residents at an expedited clip, boding well for owners of existing complexes. In-migration to Dallas-Fort Worth is expected to surpass 70,000 new residents this year, a total that will lead the nation. As a result of the new people and households they create, apartment absorption will exceed deliveries in 2022, producing downward vacancy pressure and sustaining rent.

Property Highlights

- 159-unit garden style community built in 1983 with continued plans of renovations

- Unit amenities include black appliances, faux wood flooring, two-inch blinds, brushed nickel hardware and fixtures, gooseneck kitchen faucets, modern lighting, two-tone paint, washer/dryer connections, spacious walk-in closets, cozy fireplace, breezy ceiling fan, patio/balcony, exterior storage, and resurfaced countertops.

- Community amenities include sparkling swimming pool, state-of-the-art fitness center, business center, grilling area, controlled access gate, and on-site laundry facility.

- The Property is located 20 minutes from revitalized downtown Dallas with more than 135,000 employees.

- Proximate to multiple prominent employers, restaurants, and retailers

- Near two higher education institutions with enrollment of more than 13,000 students; Lancaster Dallas College Cedar Valley Campus and University of North Texas Dallas.

- Conveniently positioned near three major highways, Interstate 35, 20, and Highway 342.