(Los Angeles, CA) Cove Capital Investments Founding Partners, Dwight Kay and Chay Lapin, announced the Delaware Statutory Trust sponsor firm successfully completed the purchase of a brand-new Build-to-Rent multifamily residential home community in San Antonio, TX . The purchase completes the formation of the firm’s Cove Texas Build-to-Rent 97 DST, a Regulation D, Rule 506(c) offering that has a $27,223,181 equity raise.

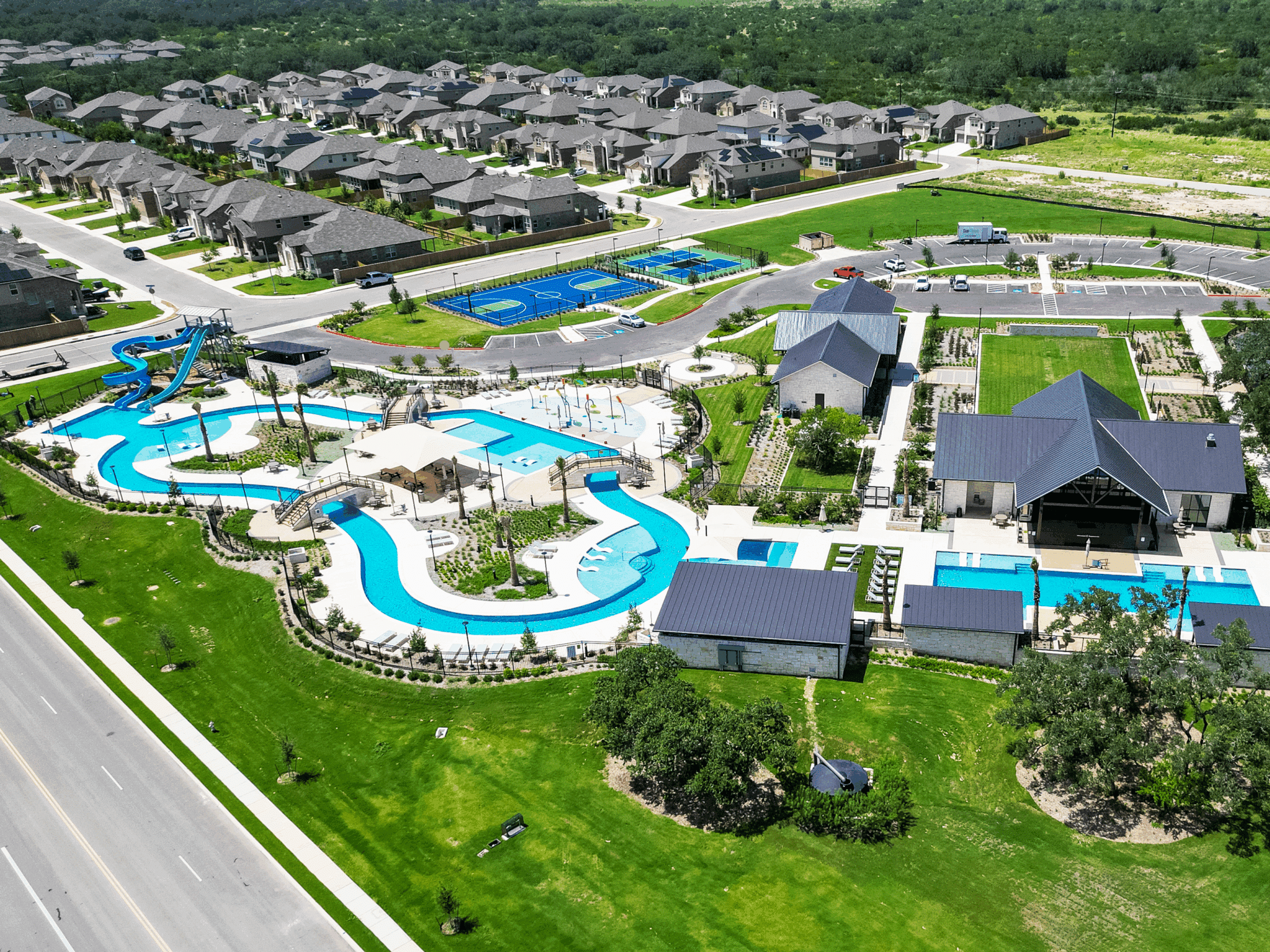

The Cove Texas Build-to-Rent 97 DST features a community of 83 newly constructed single-family rental units featuring high-end, resort style amenities and located in the thriving city of San Antonio, TX.

“This DST offering offers prospective investors an exceptional opportunity to invest in a trophy asset in one of San Antonio’s most sought-after submarkets. The Cove Dallas Build-to-Rent 97 DST is in direct proximity to some of the city’s largest employers and top-ranked schools, along with offering an extensive amenity package that includes a resort-style pool and a lazy river that continues to be a major attraction for current and prospective tenants,” said Kay.

The Cove Dallas Build-to-Rent 87 DST offering was constructed in 2024 and currently has an occupancy rate of 95% as of July 30,2025. Each of the 83 rental homes has an average square footage of 1,861 square feet. In addition, this DST offering has significant income potential for investors as there is room for potential rental rate increases as leases roll over in the coming months adding to the potential for growing revenue and Net Operating Income (NOI).

Offering Has Additional Benefits Associated with Debt-Free Acquisition Structure

Because Cove Capital acquired the asset entirely debt-free, the sellers awarded it to Cove below appraised value—creating an immediate value-add opportunity. This 100% equity structure also eliminates lender foreclosure risk, further enhancing investor protection while positioning the Cove Dallas Build-to-Rent 97 DST for potential success.

In addition, Kay explained that like many of Cove Capital’s offerings, the firm’s principals are investing their own dollars into the property creating an alignment of interest between the sponsor and investors in the offering. This is something that not all DST sponsors.

Why Build-to-Rent is Growing in Popularity for Investors and Tenants

With homeownership becoming increasingly difficult for young families due to rising home prices and mortgage rates, the Build-to-Rent or “BTR “real estate asset class has experienced strong demand from both tenants and investors.

For investors, the build-to-rent model delivers critically needed housing inventory to supply-constrained markets, providing for potentially strong demand fundamentals. In addition, because landlords can reset rents each year, the BTR model also provides investors a potential hedge against inflation.

Conversely, while tenants benefit from the flexibility of lease agreements, they are also shielded from the financial obligations typically associated with single-family homeownership such as rising insurance and maintenance costs.

Chay Lapin, Managing Member and Co-Founder of Cove Capital Investments also emphasized that this offering has the potential for a 721 Exchange rollup as a fully optional potential exit strategy.