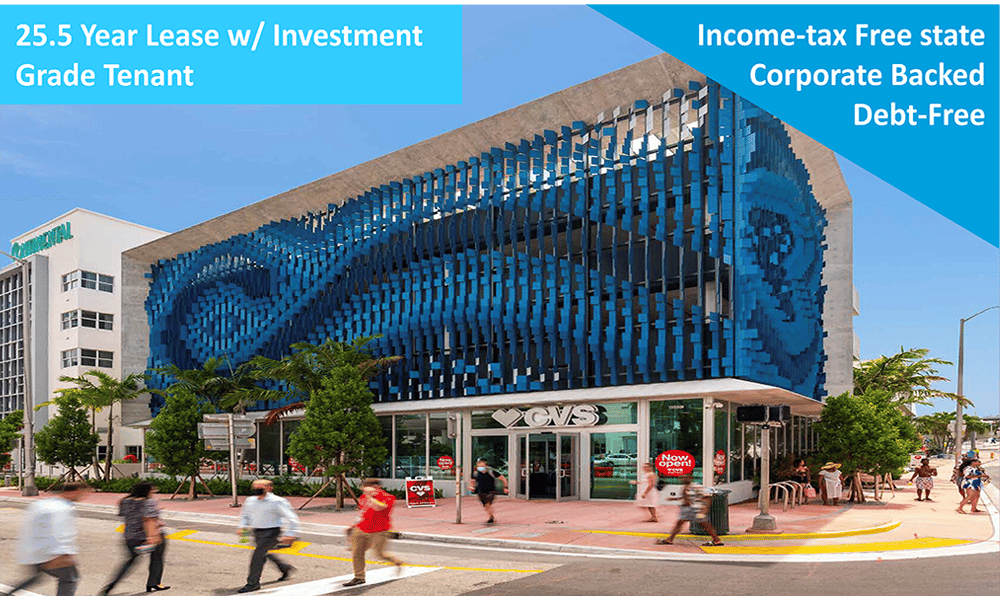

Cove Pharmacy Net Lease 46 DST

Miami Beach, FL

| Asset Class: | Single Tenant Net Lease |

| Leverage: | 0%/100% Debt-Free |

| Location(s): | Miami Beach, FL |

| Minimum Investment: | $50,000 |

| Current Distribution: | Monthly/Inquire |

| Offering Type: | DST |

| 1031 Exchange Qualified: | Yes |

Property Description

Cove Pharmacy Net Lease 46 DST is a newly constructed (2021) CVS in an irreplaceable Miami Beach location. The property is leased through 2046 with multiple renewal options. Corporately guaranteed by CVS Health Corp. (NYSE:CVS) Located in an income-tax free state.

One block from the beach on Collins Avenue, strategically located along W 41st St., Which serves as the main point of entry to Miami’s iconic beaches.

The offering is an all-cash/debt-free DST investment with no risk of a lender foreclosure.

MSA Details

Widely seen as the Gateway to Latin America, Miami-Dade’s influence has now expanded to global proportions with over 1,200 multinational corporations located in the area. International capital flows into Miami, while the city itself is investing billions into its infrastructure, from airports to seaports. The region’s transit system is also expanding rapidly with new local rail lines, and Virgin Trains’ highspeed rail system connecting the entire South Florida market, with plans for service to Orlando and Tampa in the future. The 2,400-square-mile county is located on natural and man-made barrier islands between the Atlantic Ocean and Biscayne Bay, the latter of which separates the Beach from the mainland city of Miami.

Property Highlights

- Irreplaceable Trophy Miami Beach Location

- Long-Term Lease – 25.5 Years

- All-Cash / Debt-Free DST

- New 2021 Construction

- Investment Grade Tenant BBB S&P rating

- Essential Business – Remained Open During COVID-19 Pandemic

- 100% Occupancy

Source: Indication of Interest

The market information provided above may not predict the future performance of the property.

*Distribution is not guaranteed and is subject to available cash flow. For further information about cash flow distributions from operations and capital events, please refer to the offering’s Private Placement Memorandum.