Cove Texas Net Lease 67 DST

Dallas-Fort Worth MSA

| Asset Class: | Single Tenant Net Lease |

| Leverage: | 0% - All-Cash/Debt-free |

| Location(s): | Dallas-Fort Worth MSA |

| Minimum Investment: | $50,000 |

| Current Distribution: | Monthly/Inquire |

| Offering Type: | DST |

| 1031 Exchange Qualified: | Yes |

Property Description

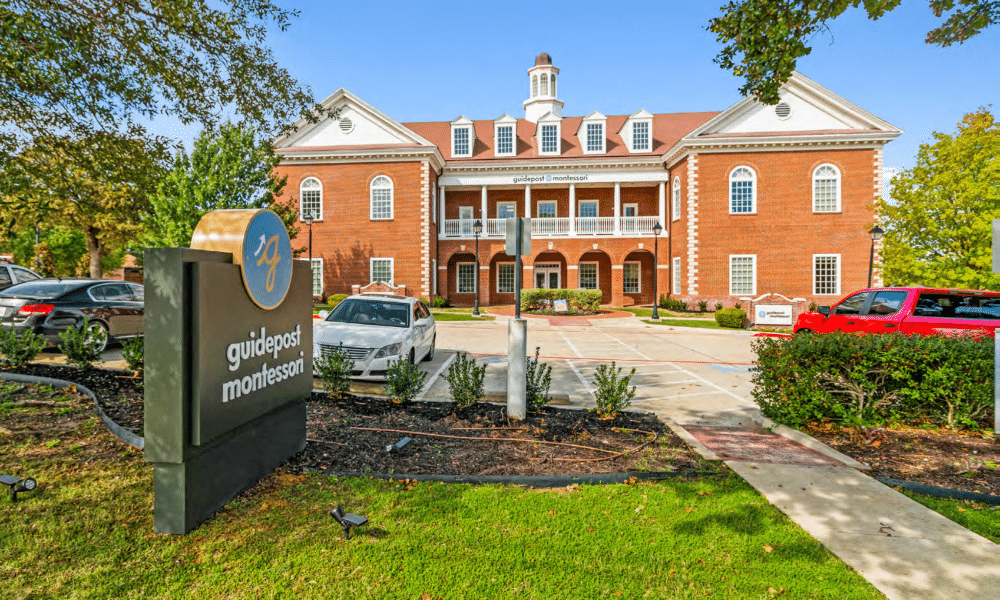

- Full Corporate Guarantee for the Duration of the Lease from High Ground Education (Parent Company of Guidepost Montessori)

- Higher Ground Education has Double Revenue Each Year Since 2016, Paid Full Rent for all of its Schools Throughout the Pandemic, and Has Seen Enrollments Double Since 2020. HGE was Valued at $250 Million in 2021.

- Higher Ground Education, Inc. is the parent company of Guidepost Montessori, and the guarantor of this property’s lease. - They are based in Lake Forest, California and have backing from Learn Capital, the largest venture capital group in the educational space.

- Mansfield and Hurst are dynamic suburban communities located in the thriving Dallas-Fort Worth Metroplex

MSA Details

The Metroplex region revolves around the cities of Dallas (Dallas County) and Fort Worth (Tarrant County). Dallas is the third-largest city in Texas; Dallas and Fort Worth are among the nation’s fastest-growing cities. In 2019, the Metroplex region accounted for nearly 30 percent of the state’s total employment, making it the largest employment base in the state. From 2010 to 2019, the region’s population grew faster than that of the state as a whole, and while the population of each county in the region rose during this period, Collin, Denton, Kaufman and Rockwall counties outpaced all others, each growing by more than 30 percent — twice as fast as the state’s population.

Property Highlights

- Guidepost Montessori has 95+ Locations Nationally and Locations Globally, Growth of 40+ Schools Annually, and Plans to Grow to 500+ Locations by 2026

- All-Cash/Debt-Free DST Offering

- Two Property Portfolio

- Income Tax Fee State of Texas

- 721 Exchange Exit Potential

Source: Brochure

The market information provided above may not predict the future performance of the property.

*Distribution is not guaranteed and is subject to available cash flow. For further information about cash flow distributions from operations and capital events, please refer to the offering’s Private Placement Memorandum.