- DSTs are a legal entity designed specifically for real estate investment purposes.

- DST properties can be both leveraged with debt, and completely debt-free.

- DST investments are a pure form of passive real estate investing, that eliminate tenants, toilets, and trash.

If you are a real estate investor and are curious about what exactly is a Delaware Statutory Trust (DST) investment, and are a little fuzzy about the details, you've come to the right place!

DST properties provide investors one possible avenue attain monthly cash flow potential, significant tax benefits, and the ability to invest in larger assets that they might not otherwise be able to.

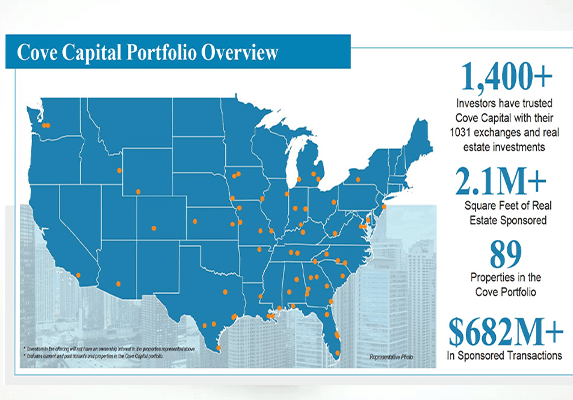

While many Delaware Statutory Trust sponsor firms only offer leveraged (lender foreclosure possibility) real estate offerings for 1031 exchange purposes, Cove Capital investments is a leader in providing investors access to 100% debt-free 1031 exchange Delaware Statutory Trust (DST) offerings.

Currently, the Cove Capital portfolio consists of over 80 properties with an acquisition value of over $600 million.

What Exactly is a Delaware Statutory Trust?

A DST is a legal entity designed specifically for the purposes of real estate investing. Contrary to the name, investors don't need to be located or invest in properties located in the State of Delaware. The most important component of a DST lies in its formation through a private governing agreement in the form of a trust that manages property on behalf of a select group of trustees.

Think of a DST as something like a limited partnership (LLC) where numerous owners collectively invest in an asset managed by a master partner. Like a LLC, a DST furnishes owners with limited liability while distributing income among the pooled owners.

Cove Capital is unique within the world of DST sponsor firms in that we 100% debt-free DST real estate investments across multiple asset classes, including multifamily DST properties, single tenant net lease Delaware Statutory Trust properties, Multi-Tenant retail Delaware Statutory Trust properties, Industrial DST Properties, and Medical Facility DST properties. An example is this California DST property for 1031 exchange and direct cash investors located in the trophy Northern San Diego County beach community of Encinitas.

You can also look at this video describing this unique debt-free single tenant net lease DST property.

What is a DST in Real Estate?

Fractional Beneficial Interest

*Diversification does not guarantee returns and does not protect against loss.

Tax Smart Investment Tool

The powerful thing about Delaware Statutory Trusts for real estate investing is that the IRS validated ownership interests within a DST to be viable as like-kind properties eligible for 1031 exchanges, enabling investors who are selling an investment property to defer any capital gains. In many cases, investors have seen their real estate investments grow substantially in value over the years and decades, and so their capital gains taxes can be quite high.

Investors use DSTs as a 1031 exchange option in order to shelter the proceeds from the sale of one asset into another like-kind property without facing capital gains taxes. Typically seen as a tax-deferring mechanism, sellers can potentially defer capital gains taxes by rolling gains from the sale of one property into subsequent 1031 exchanges. While 1031 exchanges are quite common, there are some very important rules all real estate investors must adhere to.

Here’s a quick summary of the 1031 Exchange rules investors should keep in mind when considering selling a piece of investment property:

- On day one, after selling your property, your property; proceeds must be escrowed with a Qualified Intermediary (QI).

- On day 45, investors must Identify a property(ies), and you must notify your QI of the identified property(ies).

- By day 180, investors must have closed on new property.

- Investors must maintain an equal or greater amount of equity.

- Investors must maintain an equal or greater amount of debt.

- Please make sure to speak to your CPA and attorney for all tax and legal advice prior to your 1031 exchange as Cove Capital is not able to provide you with tax or legal advice.

100% Passive Investments

In addition to the tax deferral benefits of Delaware Statutory Trusts, there is another powerful benefit investors discover upon investing in DSTs: they have more free time. Because a trustee oversees DST investment properties, Delaware Statutory Trust properties are 100% passive investments, while still providing investors with the potential for monthly income. This aspect appeals to many investors who are tired of the hassles associated with active management. They are happy to leave behind the proverbial 3 T’s: tenants, toilets, and trash that come with active management and move into a 100% passive ownership structure that allows them to enjoy retirement, grandkids, travel, and leisure.

Listen to this Cove Capital video that explains why DSTs are really pure 100% passive investments.

Important Rules that Govern DST Investments

- No future equity contributions post-offering closure are permitted.

- Additional debt financing or alterations to existing loan terms are prohibited.

- Proceeds from sales must be distributed among DST investors.

- Property capital expenditures are limited to maintenance, small improvements, or legal obligations.

- Liquid cash can only be invested in short-term debt between distribution dates.

- Regular distribution of liquid cash to investors is mandated.

- Lease negotiations are restricted unless outlined in a master leasing agreement at DST inception or due to tenant default.