DST 1031 Investment Strategy in Today’s Capital Market Environment

By Carlos Valdivia, Vice President – Multifamily – Cove Capital

Summary

- Investors in debt free multifamily value-add Delaware Statutory Trust (DST) properties have the potential for higher cash flow today than their leveraged counterparts, as well as greater upside potential tomorrow due to the value-add strategy.

- With a debt free multifamily DST asset there are no lender-imposed restrictions on investor distributions as there are with leveraged properties in the case of a breach of lender covenants.

- Debt free multifamily DST assets eliminate the potential for lender foreclosure resulting in a complete loss of investor principal – this is something that many astute investors are highly keen on due to where we are in the overall real estate, geopolitical and economic cycle.

- With a debt free multifamily DST asset, investors have eliminated refinancing risk due to loan maturities.

- If the opportunity to exit the value-add multifamily DST investment presents itself early, there are no prepayment penalties or defeasance costs that would erode investor capital in case of a sale.

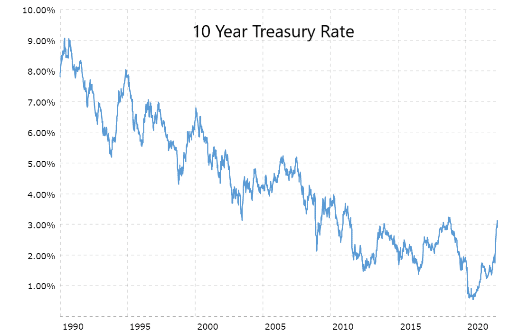

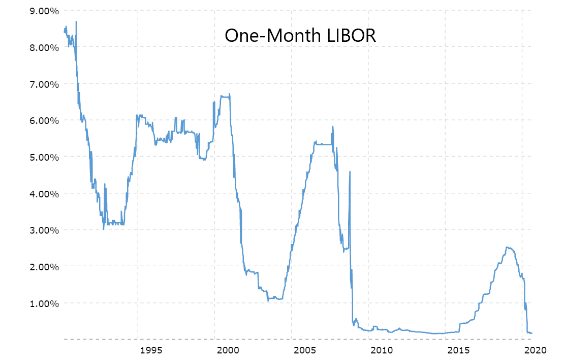

For the past 30 years U.S. capital markets have experienced a declining interest rate environment, with the 10-Year Treasury falling from a high of 9.08% in April 1990 to a low of 0.53% in July 2020. More relevant to real estate investors, the base rate LIBOR (now SOFR since mid-20211) used to determine the all-in interest rate for commercial real estate (“CRE”) and apartment building loans has also significantly declined, going from 8.56% in 1990 to 0.16% in 2020. LIBOR plus a spread (historically 160 basis points to 550 basis points) has been the predominate method used to determine the interest rate for real property loans, both fixed and adjustable.

On average, using debt or leverage has been potentially accretive to returns since 1990. (We say potentially as there have been numerous cases of investors losing their entire principal invested in a property due to lender foreclosures as evidenced by the Great Financial Crisis and the Coronavirus pandemic, which wreaked havoc on many properties that were financed with debt). For example, an investor buying a property with a 4% cap rate and a 3% interest only loan at 65% loan-to-value (“LTV”) could generate a potential 6% cash-on-cash return day 1. In today’s (July 2022) interest rate and cap rate environment, that is no longer the case.

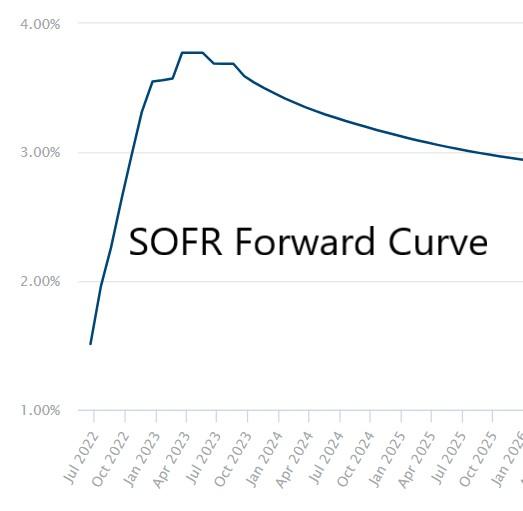

Inflation is now higher than it has been in the past 40 years, with the May 2022 CPI reading 8.6%. As

a result, the Federal Reserve has publicly stated it will continue to raise interest rates until inflation comes down to 2% over the longer term. This has led to a dramatic increase in future interest rate expectations, with SOFR projected to go from 0.77% today to 3.77% a year from now, implying real property loan interest rates will go from 4.25% today to 5.5% plus based on historical spreads. To generate that same potential 6% cash-on-cash return with a 5.5% interest only loan, an investor will have to buy a property at a 5.7% cap rate.

Unfortunately, cap rates do not rise or fall in direct proportion to interest rate changes. In addition to interest rates, cap rates are also influenced by how much capital is in the market chasing deals, the expected yield on other available investments (stocks, bonds, etc.), and the upside potential through strengthening fundamentals or investor value-add. Even though real property interest rates have increased over 1.5% since the beginning of 2022, cap rates have only expanded by approximately 0.75% or less, and for many value-add properties cap rates have barely changed as it is a highly sought after product type in today’s market.

Today’s interest rate environment and the continued historically low cap rates have resulted in negative leverage, where the cost of debt, or the interest rate, is higher than the potential return on equity for the first couple of years. For example, investors are buying multifamily apartments with a value-add strategy at a 4.0% cap rate on Year 1 NOI. Assuming a 65% LTV and 5.5% interest rate implies investors are getting a potential 1.2% cash-on-cash return on Year 1 income. Given the risk/reward profile of debt versus equity, equity returns should be higher than debt to compensate for the additional risk an equity investment represents. However, in a world where U.S. Government Bonds and the S&P 500 have lost 12% and 19.8%, respectively, in 2022 year-to-date, a positive 1.2% return is acceptable for many institutional and private investors. This puts downward pressure on cap rates, keeping them unchanged, in our example, at 4.0% despite higher interest rates.

No one knows how much interest rates will rise or when they will stop rising. As the prospects of a recession grow stronger2 no one can tell with certainty how deep that recession will be or how long it will last. Most DST 1031 property loans come with covenants, one being the debt-service coverage ratio (“DSCR”). As interest rates rise or if property NOI decreases due to a recession, the chances of breaching the DSCR covenant increases significantly. If that happens, the lender can put the property into a “cash sweep” or “Cash Management” and restrict the property from paying any sort of distribution, even if there is ample positive cash flow to do so. In a worst-case scenario, if the property is unable to generate enough cash flow to service the debt, the lender can foreclose on the property thereby completely wiping out 100% of investor equity.

Moreover, many loans have an acceleration clause where the lender can demand immediate repayment of the loan if certain covenants are breached, like the DSCR. The owner may not be able to refinance the existing loan without having to contribute additional capital because the amount of the new loan will be less than the balance of the existing one. Higher interest rates, cap rate expansion, or a decline in NOI will all negatively impact the value of the property and the amount of proceeds available via a refi. Finally, there often exist interest rate hedging costs, prepayment penalties, and defeasance costs that become incredibly more onerous as interest rates rise. A DST sponsor company with a leveraged multifamily DST 1031 property could be subject to prepayment penalties and/or defeasance costs in the millions of dollars that would drastically erode the amount of net sales proceeds upon the full cycle liquidity event of the DST.

Given all the uncertainty that exists right now with regards to interest rates, cap rates, the economy, and the world, at Cove Capital we believe the best course of action is to not put investor capital unnecessarily at risk with the use of leverage. Per the example above, there are solid opportunities to potentially generate attractive risk-adjusted returns without having to encumber the property with debt, and subject investor capital to needless risk and potential loss when many are predicting economic headwinds on the horizon.

ABOUT COVE CAPITAL INVESTMENTS

Cove Capital Investments is a private equity real estate firm providing accredited investors access to 1031 exchange eligible Delaware Statutory Trust properties as well as other real estate investment offerings. The Cove Capital team consists of Acquisitions, Asset Management, Accounting, Due Diligence, In-House Counsel, Investor Relations, Marketing and Capital Markets. Cove Capital maintains a robust current inventory of DST and private equity real estate offerings potentially available to investors. Cove Capital Investments has sponsored and co-sponsored the syndication of over 3.4 million square feet of 1031 DST and real estate offerings in the multifamily, net lease, industrial and office sectors. The Principals of Cove Capital Investments seek to invest alongside investors in each of their offerings. For further information, please visit www.covecapitalinvestments.com or contact Cove Capital at (877) 899-1315 and via email at info@covecapitalinvestments.com. This material does not constitute an offer to sell nor a solicitation of an offer to buy any security. Such offers can be made only by the confidential Private Placement Memorandum (the “Memorandum”). Please read the entire Memorandum paying special attention to the risk section prior to investing. This correspondence contains information that has been obtained from sources believed to be reliable. However, Cove Capital Investments, LLC does not guarantee the accuracy and validity of the information herein. Investors should perform their own investigations before considering any investment. IRC Section 1031, IRC Section 1033 and IRC Section 721 are complex tax codes therefore you should consult your tax or legal professional for details regarding your situation. This material is not intended as tax or legal advice. There are material risks associated with investing in real estate, Limited Liability Company owned (LLC) properties, LLC interests, Delaware Statutory Trust (DST) properties, and real estate securities including illiquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and net lease properties, short term leases associated with net lease properties, financing risks, potential adverse tax consequences, general economic risks, development risks and long hold periods. There is a risk of loss of the entire investment principal. Past performance is not a guarantee of future results. Potential cash flow, potential returns and potential appreciation are not guaranteed. For an investor to qualify for any type of investment, there are both financial requirements and suitability requirements that must match specific objectives, goals and risk tolerances. Nothing contained in this material, including in this disclosure or in any other disclosure in this message, constitutes tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through FNEX Capital, member FINRA SIPC.

Footnotes:

* In 2017, global regulators and market participants began the process of phasing out LIBOR as a reference rate due to the rate being susceptible to manipulation. As a result, in the U.S. the Alternative Reference Rates Committee (ARRC), comprised of private market participants convened by the Federal Reserve Board and the Federal Reserve Bank of New York, recommended the Secured Overnight Financing Rate (SOFR) as the rate to represent best practices in U.S. dollar derivatives and financial markets. On Dec. 1, 2020, the Board of Governors of the Federal Reserve System, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation issued a statement mandating the cessation of issuing any new LIBOR-based contract including loans after Dec. 31, 2021, and to use SOFR in place of LIBOR.