The all-cash/debt-free distribution facility DST offering in Elk Grove Village, IL goes full cycle to post total returns of 121.08% for accredited investors

Key Highlights:

- Cove Capital Investments takes custom logistics/distribution DST property full-cycle

- Cove Capital Investments correctly anticipated the O’Hare Airport adjacent location combined with the lack of quality warehouse space nationwide created a favorable investment environment.

- The debt free DST offering realized a 12.37% annualized return for investors.*

Click to Enlarge

(TORRANCE, CA ) Cove Capital Investments, a private equity real estate firm and DST sponsor company known for providing accredited investors access to 1031 exchange eligible Delaware Statutory Trust offerings as well as other real estate investment offerings, announced it has successfully brought one of its debt free DST offerings full cycle on behalf of multiple 1031 exchange and cash investors.

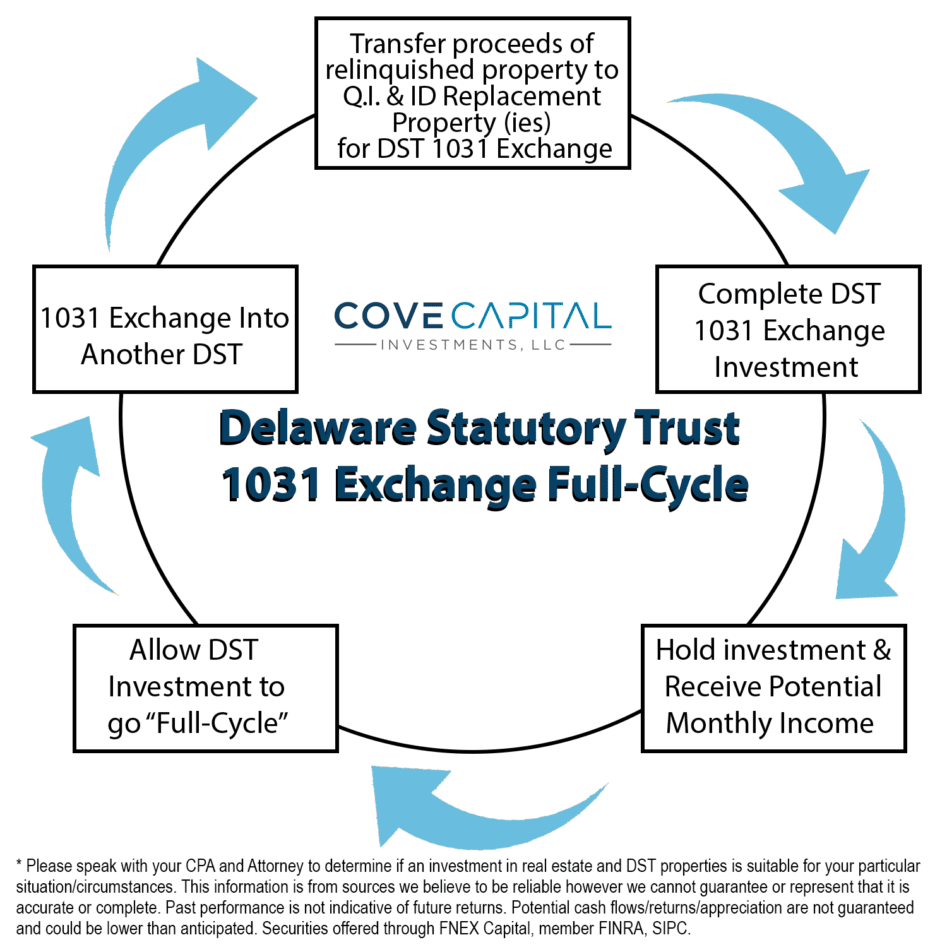

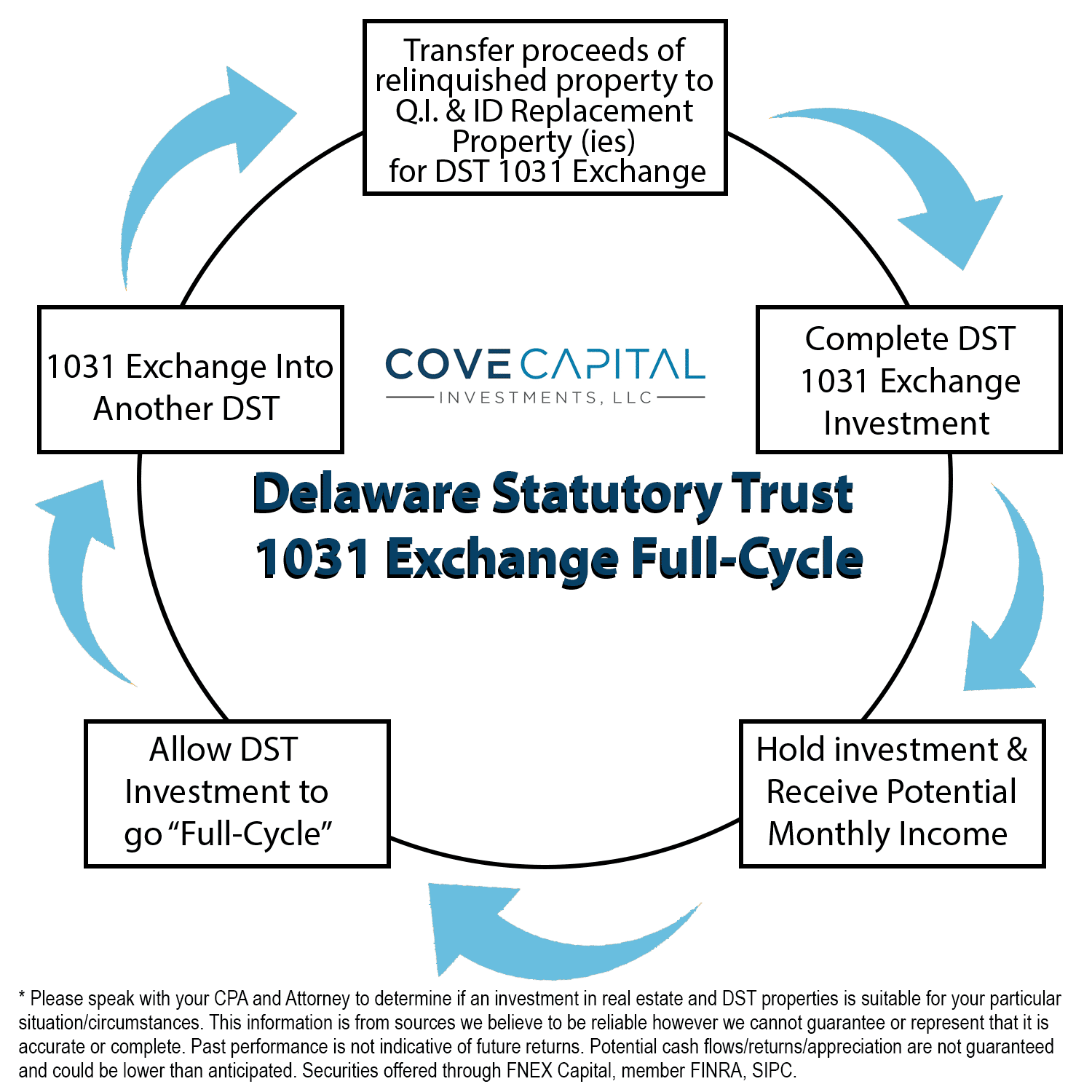

“Full Cycle” is the name used to describe a Delaware Statutory Trust property that is purchased and then sold on behalf of a group of accredited investors after a period of time.

According to Chay Lapin, Managing Director of Cove Capital Investments, the property, Airport Distribution 21 DST located in Elk Grove Village, IL sold on behalf of a group of DST accredited investors who, for those investors that closed simultaneously on the DST investment the same day that the property was purchased, realized a 121.08% total return on their investments, or a 12.37% annualized return from their DST 1031 investment*.

“The property was offered to investors as an all-cash/debt-free investment in order to create a lower-risk profile for both 1031 Exchange and direct cash investors. Although past performance does not guarantee future results and all real estate investments contain the risk of loss of principal and projected cash flow being lower than anticipated, we are very pleased to have provided another successful all-cash DST investment opportunity with no long-term leverage for our clients that resulted in a full-cycle liquidity event*,” said Lapin.

In addition, Lapin noted that Cove Capital was able to provide its investors uninterrupted monthly distributions throughout the hold period and during the COVID-19 pandemic, a significant accomplishment considering the challenges that many real estate operators experienced with tenants and rent collections during the pandemic.

“While past performance does not guarantee or indicate the likelihood of future results, this particular DST investment was structured as a custom all-cash/debt-free DST and successfully sold for an attractive total return for our investors. The positive return marks a significant victory for our investors and another successful outcome for the entire Cove Capital team*,” said Lapin.

Lapin explained that this custom logistics DST asset consisted of a 36,395 square foot distribution facility located in the Elk Grove Village submarket of greater Chicago. The facility had been consistently occupied by an investment grade tenant for many years, and was located just eight miles from the O’Hare International Airport in the heart of one of the nation’s most active logistics centers.

“Our investment team identified this logistics facility as a potentially high-quality asset that was in high demand and located in a dense infill location. Furthermore, the booming e-commerce industry and a stable investment-grade tenant created what we believed to be a favorable investment scenario,” said Lapin.

Lapin further explained that because there is a limited supply of quality logistics facilities currently available across the country, the combination of a solid location and a high-quality logistics and distribution tenant made the Airport Distribution 21 DST a particularly attractive investment for Cove Capital Investments.

“We originally acquired the property because we saw there was a great opportunity for a logistics facility that was 100% occupied by a Fortune 500 distribution tenant. Like all of our Delaware Statutory Trust investments, this DST was carefully vetted by the Cove Capital team of due diligence, legal and acquisitions experts before we made it available as a debt free DST for investors. Although the past performance of any investment doesn’t ever guarantee future results or returns, the offering’s monthly distributions performed exactly as we had anticipated in the Private Placement Memorandum (PPM)*,” said Lapin.

ABOUT COVE CAPITAL INVESTMENTS

Cove Capital Investments is a private equity real estate firm providing accredited investors access to 1031 exchange eligible Delaware Statutory Trust properties as well as other real estate investment offerings. The Cove Capital team consists of Acquisitions, Asset Management, Accounting, Due Diligence, In-House Counsel, Investor Relations, Marketing and Capital Markets. Cove Capital maintains a robust current inventory of DST and private equity real estate offerings potentially available to investors. Cove Capital Investments has sponsored and co-sponsored the syndication of over 3.4 million square feet of 1031 DST and real estate offerings in the multifamily, net lease, industrial and office sectors. The Principals of Cove Capital Investments seek to invest alongside investors in each of their offerings.

For further information, please visit www.covecapitalinvestments.com or contact Cove Capital at (877) 899-1315 and via email at info@covecapitalinvestments.com.

* Diversification does not guarantee profits or protect against losses.

* Past performance is not a guarantee of future results.

This material does not constitute an offer to sell nor a solicitation of an offer to buy any security. Such offers can be made only by the confidential Private Placement Memorandum (the “Memorandum”). Please read the entire Memorandum paying special attention to the risk section prior to investing. This correspondence contains information that has been obtained from sources believed to be reliable. However, Cove Capital Investments, LLC does not guarantee the accuracy and validity of the information herein. Investors should perform their own investigations before considering any investment. IRC Section 1031, IRC Section 1033 and IRC Section 721 are complex tax codes therefore you should consult your tax or legal professional for details regarding your situation. This material is not intended as tax or legal advice. There are material risks associated with investing in real estate, Limited Liability Company owned (LLC) properties, LLC interests, Delaware Statutory Trust (DST) properties, and real estate securities including illiquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and net lease properties, short term leases associated with net lease properties, financing risks, potential adverse tax consequences, general economic risks, development risks and long hold periods. There is a risk of loss of the entire investment principal. Past performance is not a guarantee of future results. Potential cash flow, potential returns and potential appreciation are not guaranteed. For an investor to qualify for any type of investment, there are both financial requirements and suitability requirements that must match specific objectives, goals and risk tolerances. Nothing contained in this material, including in this disclosure or in any other disclosure in this message, constitutes tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through FNEX Capital, member FINRA, SIPC.