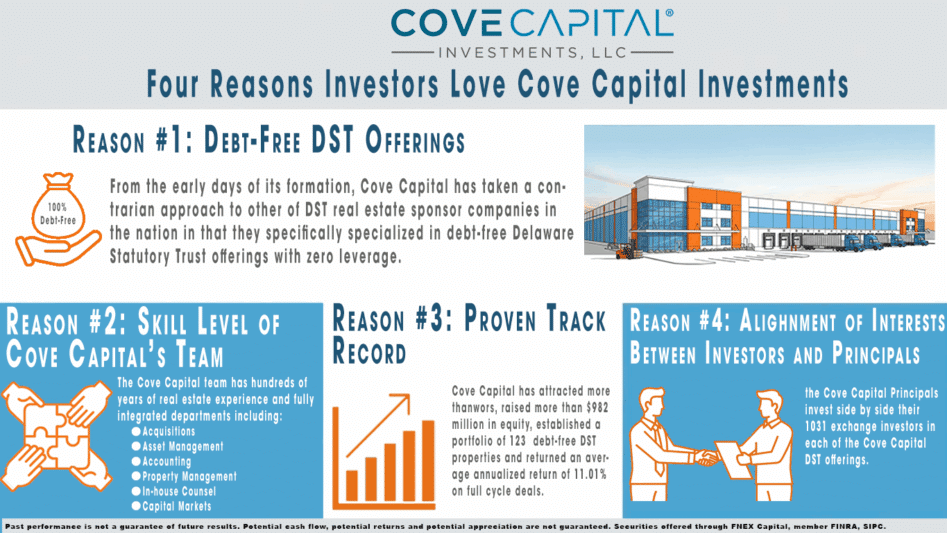

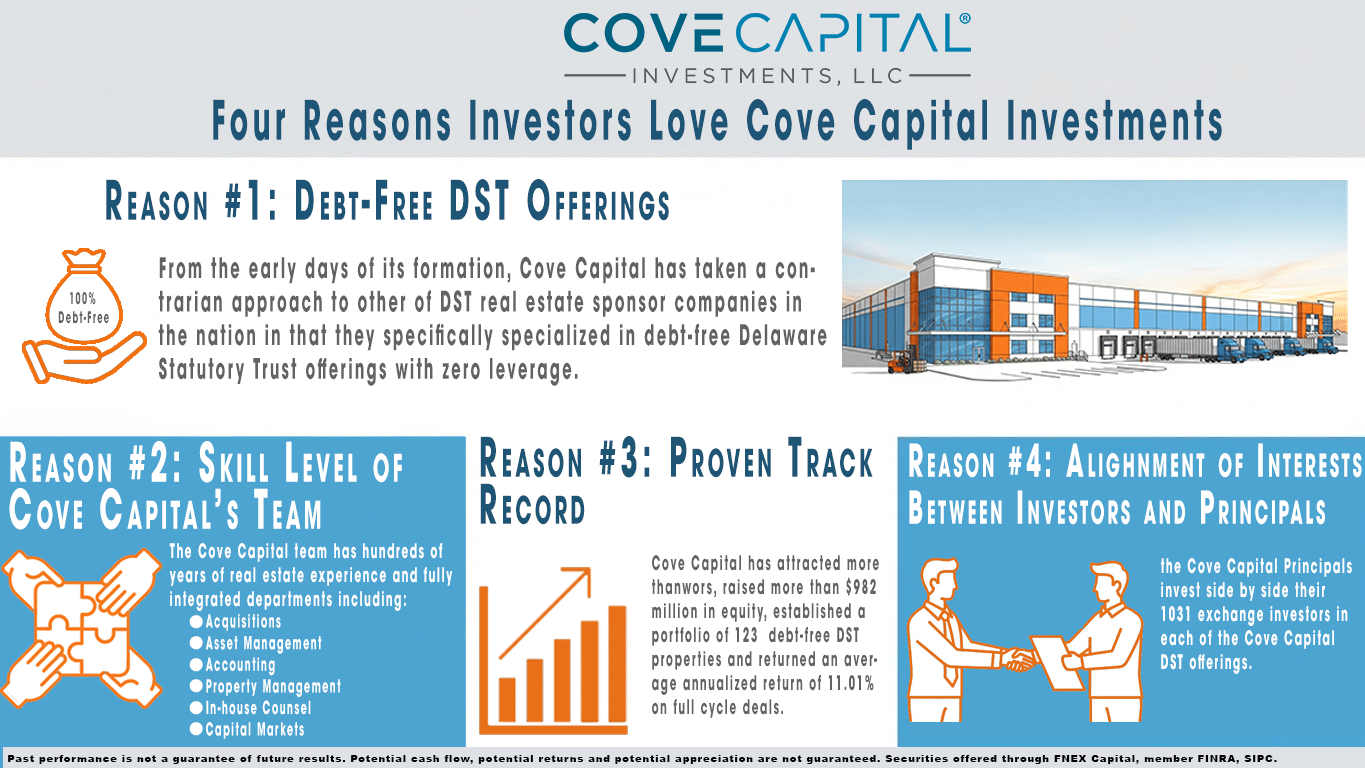

Cove Capital Investments is a leading real estate sponsor company specializing in debt-free Delaware Statutory Trust investments.

To date, Cove Capital has raised more than $982 million in equity, attracted more than 2,400 investors (many of which are repeat investors), assembled 123 properties within the Cove Capital portfolio, and provided more than $168 million in returns for investors while delivering an impressive 11.01% in average annualized returns on full-cycle DST offerings.*

When taking a step back and discussing the success of Cove Capital with co-founders and managing members, Dwight Kay and Chay Lapin, there are four specific reasons they believe the Cove Capital business model has been so successful.

So, let’s break down these critical strategic advantages that make Cove Capital investments one of the most successful. In a nutshell, these reasons include:- Strategic Vision and Unique Defensive Positioning within the DST and 1031 Investment Industry

- Proven DST Investment Track Record*

- Level of Professional Real Estate Skill and Years of Experience inside Cove Capital Investment’s team.

- Level of Commitment Principals Show for the DST Properties they Make Available to 1031 exchange and Direct Cash Investors

* Past performance is no guarantee of future DST offering results. Future results may vary. Please read each DST investments Private Placement Memorandum to discuss the business plan and risk factors thoroughly. Potential cash flow, potential returns, and potential appreciation are never guaranteed.

Reason #1:

Strategic Vision Emphasizing Debt-Free Offerings and Defensive Positioning for Long-Term Stability

One of the things that distinguishes Cove Capital Investments from the majority of other DST sponsor firms is its commitment to minimizing risk for investors. From the beginning days of its formation, Cove Capital has taken a contrarian approach than other of DST real estate sponsor companies in that they specifically specialized in debt-free Delaware Statutory Trust offerings with zero leverage.

This emphasis on debt-free DST real estate offerings is steeped in the philosophy that preserving investors' capital should be the number one goal of any DST sponsor firm and that debt is one of the most significant risk factors in any real estate investment. Removing the debt component mitigates a substantial element of risk.

To hammer this reality home, readers need only to look at recent headlines that are full of examples of some of the largest real estate firms in the world who are having to give properties back to the bank because they purchased these properties with significant leverage and now cannot refinance at acceptable rates to make the investments profitable.

Reason #2:

Proven Track Record*

* Past performance is no guarantee of future DST offering results. Future results may vary. Please read each DST investments Private Placement Memorandum to discuss the business plan and risk factors thoroughly. Potential cash flow, potential returns, and potential appreciation are never guaranteed.

Since its founding, Cove Capital has attracted more than 2,400 investors, raised more than $982 million in equity, established a portfolio of 123 properties and returned an average annualized return of 11.01% on full cycle deals. across 33 states. Last year, Cove Capital from successfully closed $164 million of equity from accredited and direct cash investors, which helped propel Cove Capital Investments into the top 10 list of Delaware Statutory Trust sponsor companies in the nation based on equity raised.1

Beyond market metrics, a key benchmark for DST sponsors is the performance data from their closed, full-cycle events. "Full Cycle" is the name used to describe a Delaware Statutory Trust property purchased and sold on behalf of a group of accredited investors after a period of time.

Since its founding, Cove Capital Investments has successfully completed several profitable full-cycle events. Below is a sample of some of these full-cycle events.

A Partial List of Cove Capital Full Cycle Events

*Past performance does not guarantee or indicate the likelihood of future results.

*Average Annualized return is defined as total return including profit on sale and monthly distributions earned on an annualized basis and is calculated as if an investor closed on their DST investment the same day that the DST closed on the property.

*Total return consists of initial return of investor principal, monthly distributions, and profit upon sale.

| Offering Name | Cove Greenville 17 Debt Free DST |

|---|---|

| Asset Class | Single Tenant Net Lease |

| Average Annualized Returns | 12.60% |

| Location | Greenville, SC |

| Offering Loan-to-Value | 0% LTV (Debt-Free) |

| Total Return* | 121.57% |

| Offering Name | Cove Missoula Multifamily Debt-Free DST |

|---|---|

| Asset Class | Multifamily |

| Location | Missoula, MT |

| Offering Loan-to-Value | 0% LTV (Debt-Free) |

| Average Annualized Returns | 18.29% |

| Total Return* | 149.21% |

| Offering Name | Cove Tacoma Data Center Debt Free DST |

|---|---|

| Asset Class | Net Lease Data Center |

| Location | Tacoma, WA |

| Offering Loan-to-Value | 0% LTV (Debt-Free) |

| Average Annualized Returns | 5.57% |

| Total Return* | 116.90% |

| Offering Name | Cove Winston-Salem Industrial Distribution Facility DST |

|---|---|

| Asset Class | Distribution Center Net Lease |

| Location | Winston-Salem, NC |

| Offering Loan-to-Value | 0% LTV (Debt-Free) |

| Average Annualized Returns | 7.19% |

| Total Return* | 126.72% |

| Offering Name | Cove Airport Distribution 21 Debt free DST |

|---|---|

| Asset Class | Industrial Net Lease |

| Location | Elk Grove, IL |

| Offering Loan-to-Value | 0% LTV (Debt-Free) |

| Average Annualized Returns | 12.37% |

| Total Return* | 121.08% |

| Offering Name | Cove Dulles Distribution Debt free DST |

|---|---|

| Asset Class | Industrial Net Lease |

| Location | Washington, D.C. Metro Area |

| Offering Loan-to-Value | 0% LTV (Debt-Free) |

| Average Annualized Returns | 8.67% |

| Total Return* | 126.44% |

| Offering Name | Cove Acquisition Fund I, LLC |

|---|---|

| Asset Class | Debenture |

| Location | Various Locations |

| Offering Loan-to-Value | 0% LTV (Debt-Free) |

| Average Annualized Returns | 7.00% |

| Total Return* | 109.80% |

Reason #3:

Amount of Skill and Experience within the DST Sponsor Company

- Acquisitions Department

- Asset Management Department

- Accounting Department

- Property Review and Analysis Department

- Property Management Department

- In-house Counsel and Paralegals

- Investor Relations

- Marketing

- Capital Markets Group

Reason #4:

Level of Commitment to the Properties they Make Available to Investors

A wise saying warns, “Never trust a cook who won’t eat their own food.” At its core, this principle highlights the necessity of genuine confidence and alignment of interest—if the chef lacks faith in the meal, why should the diner?

This concept translates directly to Delaware Statutory Trust investing. A sponsor’s conviction in a DST property is best demonstrated when they invest their own capital alongside their investors. It is the ultimate alignment of interest.

Cove Capital Investments has sponsored over 2 million square feet of DST properties across a variety of sectors, including multifamily, industrial, and multi-tenant retail. In nearly every offering, the Cove Capital Principals invest directly in each offering, standing side-by-side with their 1031 exchange investors clearly demonstrating that they “eat their own cooking.”

In Conclusion:

* Past performance is no guarantee of future DST offering results. Future results may vary. Please read each DST investments Private Placement Memorandum for a full discussion of the business plan and risk factors. Potential cash flow, potential returns and potential appreciation are never guaranteed.

1. Mountain Dell Consulting, 1031 DST/TIC Market Equity Update, 12/31/2023