Can You 1031 Into a REIT?

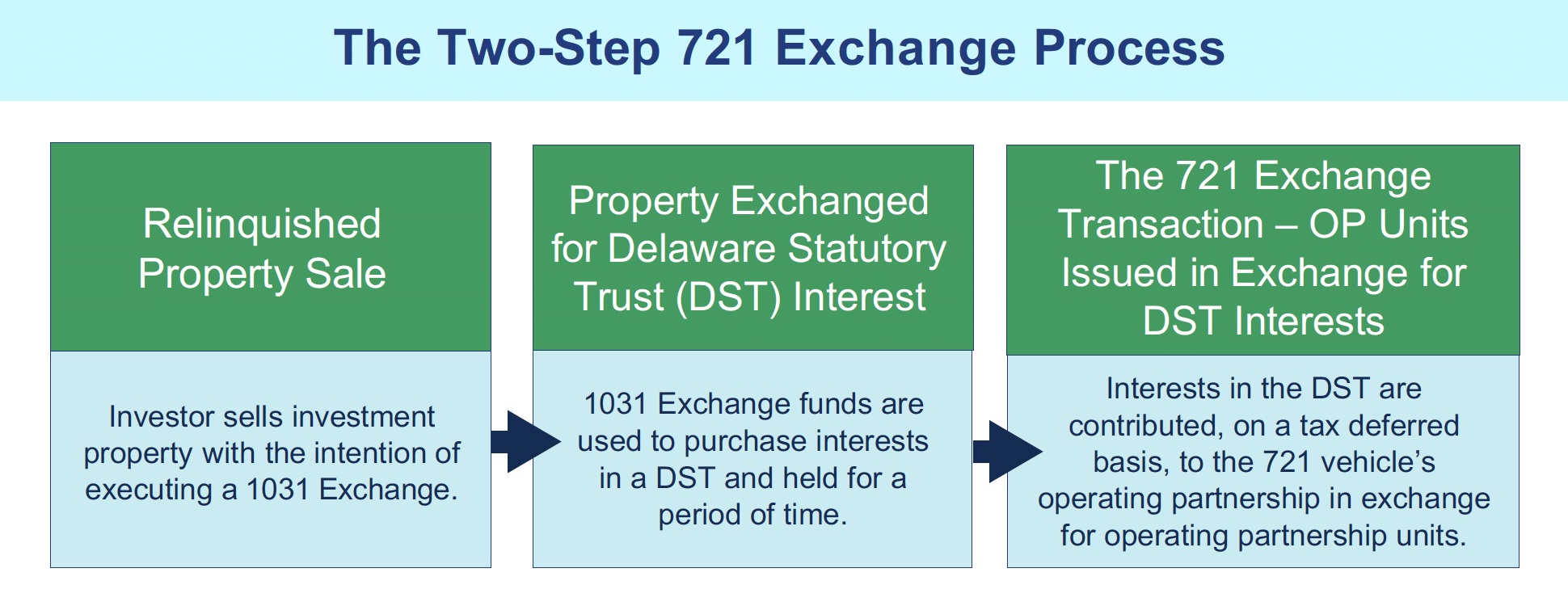

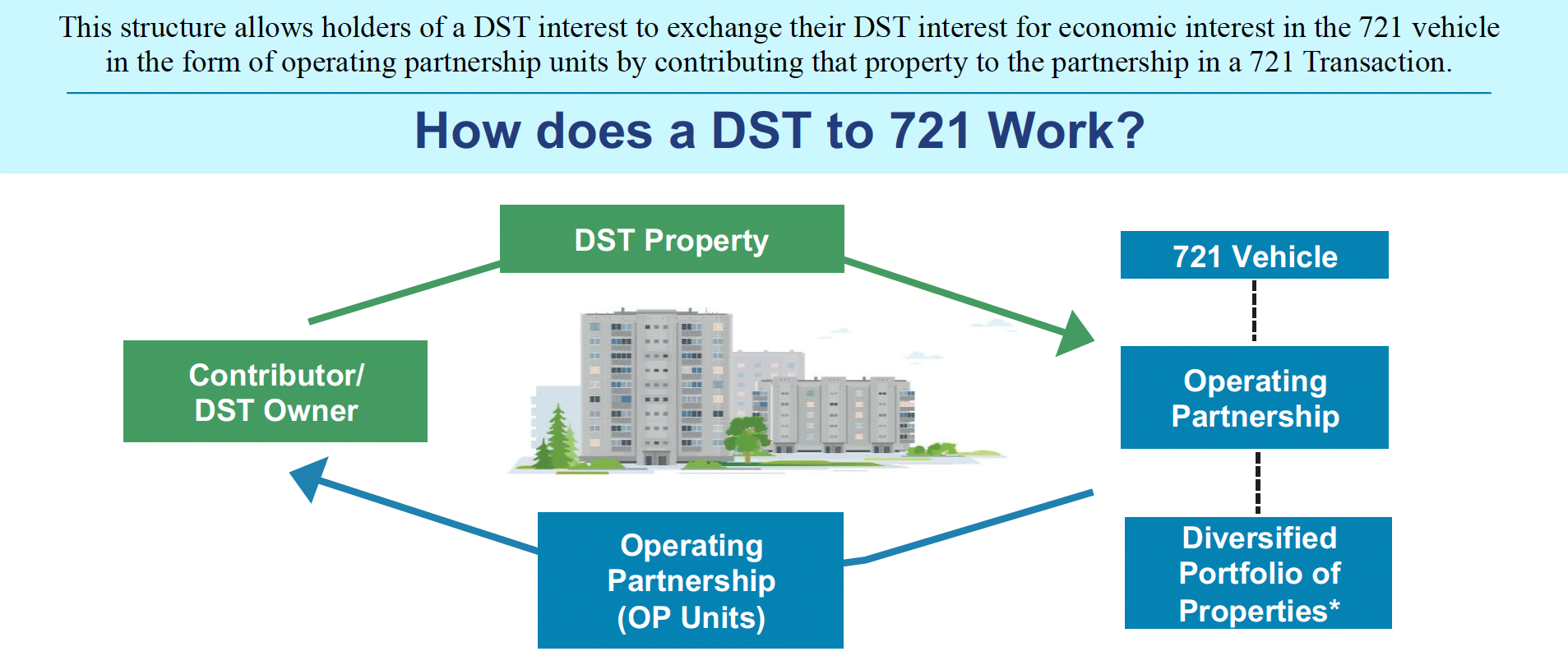

Discover the 721 Exchange Strategy

Discover how accredited investors are leveraging DSTs and 721 exchanges to transition into REITs—while deferring capital gains.

Cove Essential Net Lease Portfolio 89 DST

| Asset Class: | Single Tenant Portfolio |

| Leverage: | 0% - All-Cash/Debt-Free |

| Location(s): | MO & NC |

| Minimum Investment: | $100,000 |

| Offering Type: | DST |

| 1031 Exchange Qualified: | Yes |

*Distribution is not guaranteed and is subject to available cash flow. For further information about cash flow distributions from operations and capital events, please refer to the offering’s Private Placement Memorandum.

Cove Essential Net Lease Industrial 93 DST

| Asset Class: | Industrial |

| Leverage: | 0% - All-Cash/Debt-Free |

| Location(s): | Clinton, OK |

| Minimum Investment: | $100,000 |

| Offering Type: | DST |

| 1031 Exchange Qualified: | Yes |

*Distribution is not guaranteed and is subject to available cash flow. For further information about cash flow distributions from operations and capital events, please refer to the offering’s Private Placement Memorandum.

Cove Dallas MSA Small Bay Industrial 91 DST

| Asset Class: | Multi-Tenant |

| Leverage: | 0% - All-Cash/Debt-Free |

| Location(s): | Dallas MSA, TX |

| Minimum Investment: | $100,000 |

| Offering Type: | DST |

| 1031 Exchange Qualified: | Yes |

*Distribution is not guaranteed and is subject to available cash flow. For further information about cash flow distributions from operations and capital events, please refer to the offering’s Private Placement Memorandum.

Why Investors Choose Cove Capital

$800M+

in Offerings

2,585,400

Square Feet of Sponsored Real Estate

106

Properties in the Cove Portfolio

1,950+

Cove Capital

Investors

Over $135M

in Capital Returned to Investors Since Inception

11.01%

Average Annualized Return on Full Cycle Debt Free DST Offerings*

Past performance does not guarantee or indicate the likelihood of future results. No representation is made that any DST or investment will or is likely to achieve profits similar to those achieved in the past or that losses will not be incurred on future offerings. All information is as of 10.22.24 and subject to change after this date. For the most updated track record please contact Cove Capital. The individual DST offering average annualized return consists of total distributions and net proceeds upon sale, less the original invested equity, over the life of the investment. The average annualized return on all full cycle DSTs is the total simple average of the individual full cycle DST offerings.